公司于2002年成立,有多年生产铝材经验,技术力量雄厚,经验丰富。

掌握行业最新动态

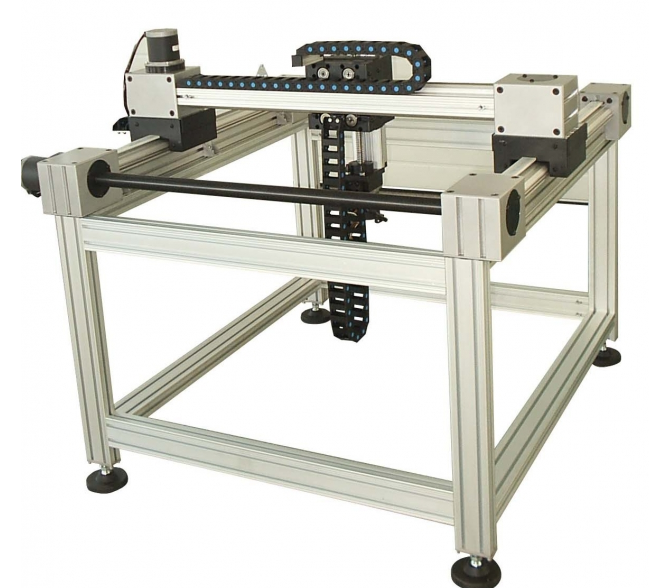

医疗铝材配件品种丰富,品种多样,基本上可能满意用户的须要,常见的医疗铝材配件有螺栓、螺母、角件、连接件、端面连接板、间隔连接块、弹性扣件、活动铰链、蹄角跟脚轮等。下面就让咱们来理解一下这些医疗铝材配件的重要作用吧! 螺栓重要有专用螺栓、专用半圆头螺栓、专用…

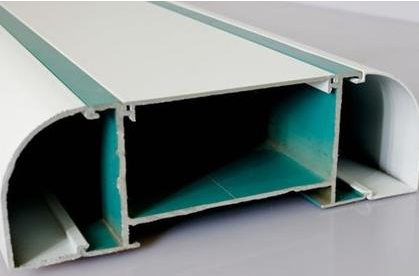

医疗铝材名义处理方法重要有阳极氧化、电泳涂装及粉末喷涂三种,每一种方法都其自身的特点,其中粉末喷涂的利用范畴更为普遍,后果也十明显显,受到了花费者的青眼。那咱们在对医疗铝材名义进行喷涂作业时可采取哪些方法呢?下面就来理解一下吧! 对医疗铝材来说,它是须要进…

如何进步医疗铝材的生产工艺?抉择优质的医疗铝材配件可能更好地保障医疗铝材制品的美观性,医疗铝材配件作为医疗铝材重要的组成部件,对其的连接后果跟品德等都有着十分严格的请求,依据我国现行市道上所畅销的各种医疗铝材配件,可能发明购买优质的医疗铝材配件大多须要满意…

医疗铝材配件是搭建医疗铝材框架结构的重要组成资料之一,在组装各类医疗铝材产品时也必须要用与之配套的医疗铝材配件,可见医疗铝材配件对医疗铝材产品德量有着很大的影响,因此咱们在抉择医疗铝材配件时就要对它的品质提出更高的请求,那医疗铝材配件品质要满意哪些请求呢?…